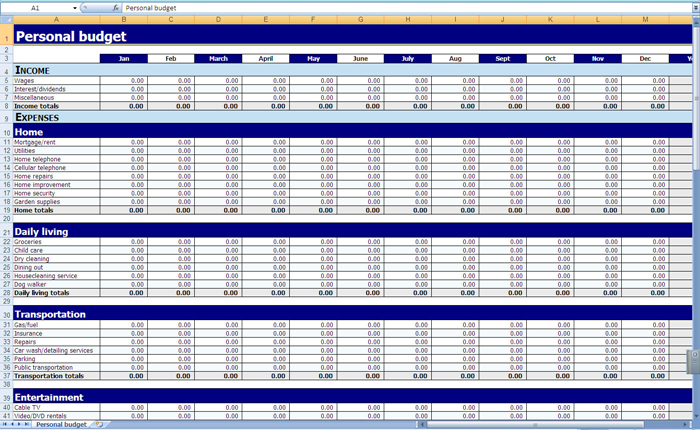

At this point you should have a pretty good idea of what both your “outgo” and income look like and where you stand in terms of how the two match up. Now it’s time to start creating a monthly budget. Remember this is all about controlling your money instead of letting your money control you. If you’d like to use a worksheet to help track your information, there are plenty free templates online (like the one pictured above) for you to use.

As we mentioned in ‘Your Money & Your: Tracking Your Cash Flow (Part 2)’, if the end result shows that your income is more than your “outgo,” then you’re off to a good start. Start looking at ways you can prioritize the excess to areas of your finances such as savings or paying off debt (we’ll talk more in depth about this later). For example, pay more than the minimum required for credit card payments and if you haven’t already, set aside an emergency fund. This will help keep you out of debt should the unexpected happen. And trust us, if it hasn’t already happened, keep living…it will.

Now, if you end up with more “outgo” than you do income, take a look at the areas in which you can make some adjustments. When doing this, here are a few things to keep in mind:

-

Figure out which of your expenses are wants and which are needs. Actual needs are limited: food, shelter, clothing, transportation. Nearly everything else is a want, but even the way we fulfill our needs involves choice.

-

Review your spending habits. Do you really need the full cable package? Do you pay full price at a convenience store for items you could buy for less on your weekly grocery shopping trips?

-

Don’t cut all the fun out of your life, just be reasonable.

Learn to moderate!

Amen!