Without support and mandates from Congress, the IRS is having a difficult time trying to combat the tax fraud issues that plague the state of Florida. According to the Federal Trade Commission, there are two major issues:

1. Under a congressional mandate to issue fast refunds, the IRS currently doesn’t verify employees’ W-2 income tax forms with their employers’ documents before the April 15 filing deadline. That gives criminals a three-month window to use stolen identities to fabricate returns and beat legitimate tax filers to their refund claims.

2. With ID theft and tax fraud escalating, the IRS implemented software “filters” in 2012 intended to detect suspicious changes in tax-filers’ home addresses, marriage status and other personal factors. But the current system, lacking the latest technology, fails to flag many bogus refunds.

In order for the IRS to fix these issues, the FTC offered two solutions:

1. Employers could submit W-2 forms to the IRS at the same time they provide them to employees in late January — giving the agency time to match tax forms before issuing refunds. To reach that goal, the IRS says it would need legislative support and more money from Congress to upgrade computer technology and hire additional employees.

2. The IRS could dramatically expand its technology to flag as many suspicious tax returns as possible, screening for — among other things — five-figure refunds or multiple returns. The agency could then contact tax filers whose returns include questionable personal information — extra scrutiny that could potentially save the IRS and taxpayers billions of dollars a year.

These solutions, however, will only scratch the surface of Florida’s excessive problem.

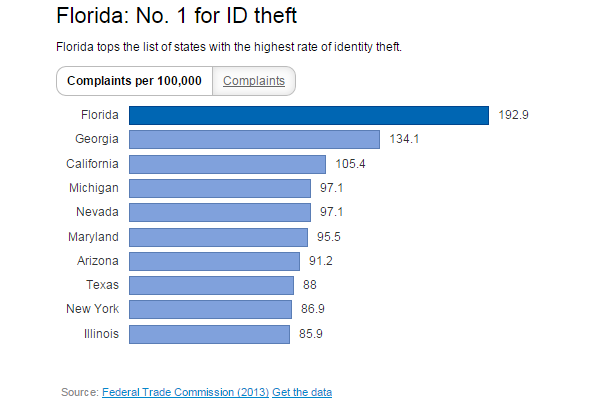

For several years now, Florida has remained the no. 1 state in tax fraud and identity theft cases. When STACKS Magazine reported on this in 2013, the IRS prevented $20 billion in refunds be paid to individuals who fraudulently filed tax returns using someone else’s identity. In 2011, $14 billion in refund payments were stopped by the IRS. To date, the number continues to grow at a staggering rate. According to data pulled by the FTC in 2013, there are 193 complaints per every 100,000 households. Georgia, California, Michigan and Nevada all round out the top 5 states for ID theft.

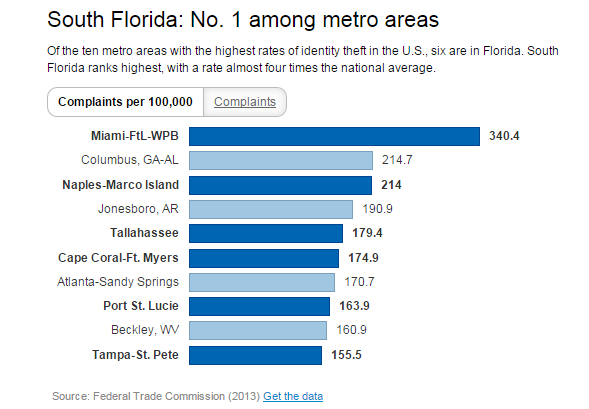

As for other areas, the IRS is cracking down on smaller towns as well. For instance, Columbus, GA and Beckley, West Virginia are listed as metro areas that rank highest in identity theft. Less populated cities are often targeted by big city culprits looking to make easy money. Why a small town? Because they are usually populated with older residents. They are easy-going communities that hardly stress security and/or ID theft protection. Too bad though…there are criminals that live all over the nation.

Until legislation support the IRS the only thing we can do as citizens is to protect our own. Here are several fraud-busting tips that’s supposed to help you and the IRS:

Secure personal information in your home.

Shred all personal financial papers.

Be careful about what you throw in the trash.

Be wary of sharing your Social Security number with anyone.

File income-tax returns as early as possible before the April 15 deadline. The IRS started accepting returns Jan. 20.

If you think you are a victim of identity theft and tax refund fraud, report the crime to local police and then contact the Internal Revenue Service at www.irs.gov. There is a link for filing a complaint and filling out an affidavit of theft and fraud. After you do, it will be assigned to a case manager, but the process is slow.

Any taxpayers who filed tax returns last year in Florida, Georgia and the District of Columbia can obtain a six-digit Identity Protection PIN from the IRS to help protect them from potential tax fraud. Anyone who qualifies should visit www.irs.gov/getanippin to register.

Source: U.S. Treasury Department; Federal Trade Commission; Miami Herald